espp tax calculator canada

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043That means that your net pay will be 37957 per year or 3163 per month. To use an example if youve purchased 10 shares for 10 100 and 10 shares for 20 200 you own 20 shares with an ACB of 300.

Taxtips Ca 2022 Earlier Basic Tax Calculator Compare 2 Scenarios

This calculator assumes that your purchase price is calculated picking the lower stock price between the purchase date and the first date of the subscription.

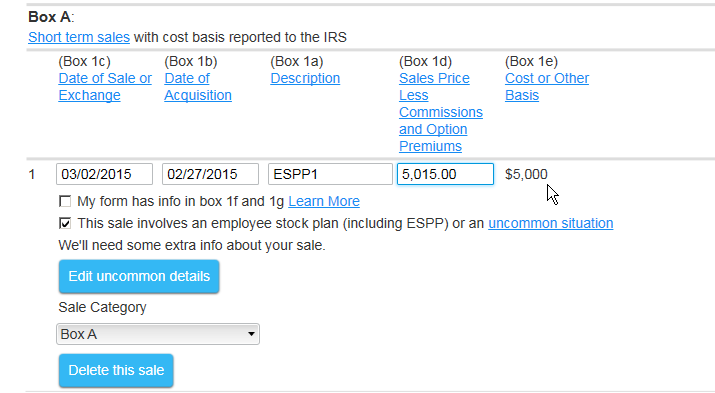

. An employee stock purchase plan ESPP is a company-run program in which participating employees can purchase company stock at a discounted price. The actual price you pay for the stock usually including a discount price from your employer The market price of the stock on that day. The gross sales price of 5000 minus the 1275 actual discounted price paid for the shares 1275 x 100 minus the 10 sales commission 3715 or.

For the ESPP those dates wont matter. This calculator actually also. The price could have risen to 200 or dropped to 100 it wont matter.

The company stock is listed on NYSE. To help you with these calculations weve built the following ESPP Gain and Tax calculator. ESPP calculator for Canadian earningcontributing in CADUSD - GitHub - aakashsethi20espp-calculator-canada.

ESPP calculator for Canadian earningcontributing in. Price shares are finally sold. According to recent case law employees may be entitled to.

In most cases the discount you received will be reported as ordinary income in Box 1 of. If you sell half 10 shares you still own. This ESPP Gain and Tax calculator will help you 1 estimate your gains from.

1700 2000 300 Number of shares. When you buy stock under an employee stock purchase plan ESPP the income isnt taxable at the time you buy it. The taxable benefit is the.

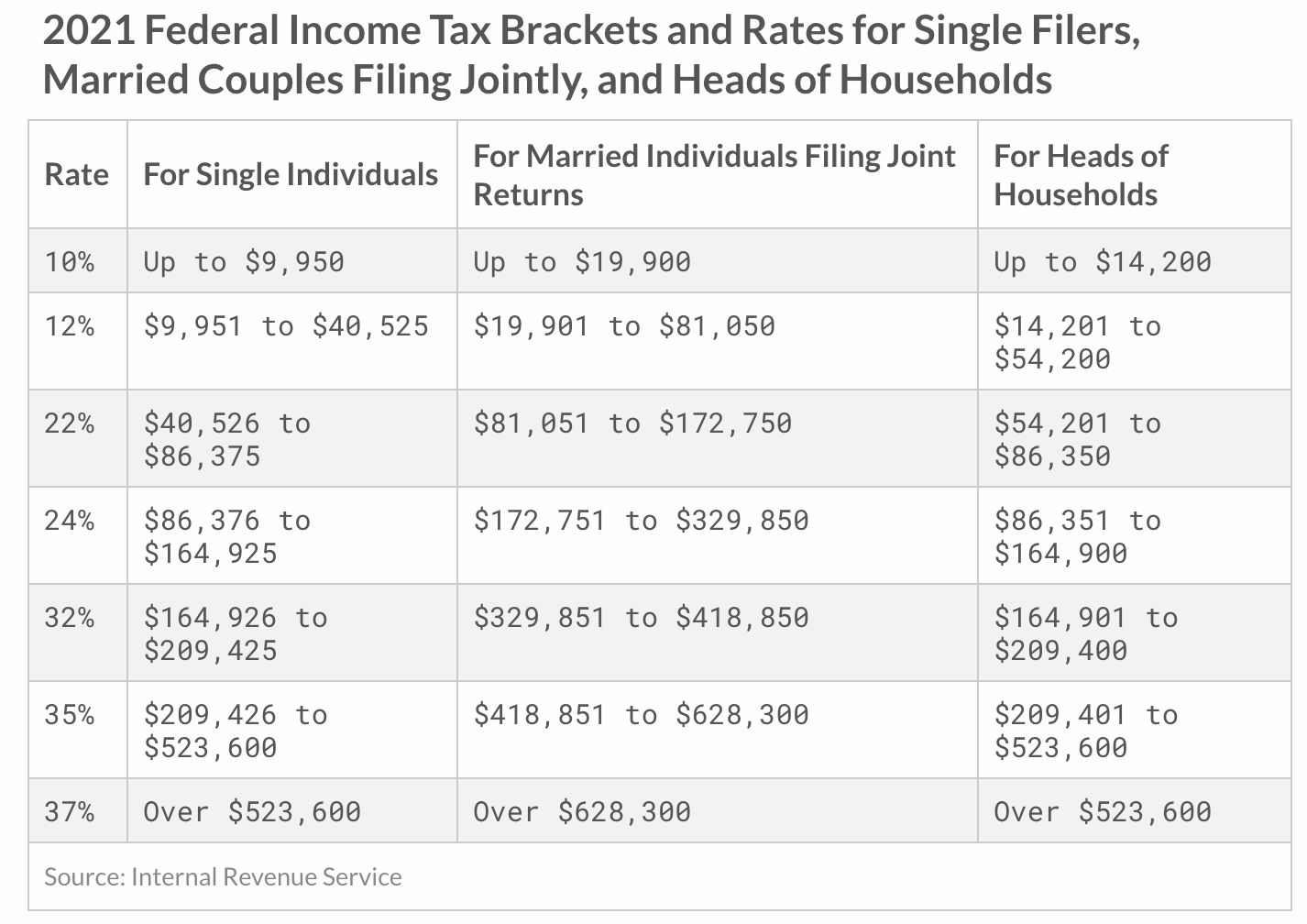

Again you are in the 24 tax bracket and 15. For more information refer to Security options deduction for the disposition of shares of a Canadian-controlled private corporation Paragraph 110 1 d1. The 1000 benefit 500 shares x 12 10 is treated as employment income and will be taxed at your marginal tax rate.

If an excess amount has been contributed to a specified employees EPSP in 2021 the excess EPSP amount is subject to a special tax. ESPP Discount of 15. ESPP Basis current About.

A specified employee is a person who. Its important that you understand both in. Your average tax rate is.

Ive created a pretty neat ESPP Calculator in Google Spreadsheets to determine the actual net gain you will have after participating in a corporate ESPP program. Generally not provided employee signs agreement acknowledging discretionary nature of the plan. Youll recognize the income and pay tax on it when you sell the stock.

Starting in 2011 the Canada Revenue Agency. My workplace has an Employee Stock Purchase Plan ESPP where we get a 15 discount off the stock price. The look back price will only take into account the price at.

Plan Entitlement - ESPP. The majority of publicly.

Employee Stock Purchase Plan Espp The 5 Things You Need To Know

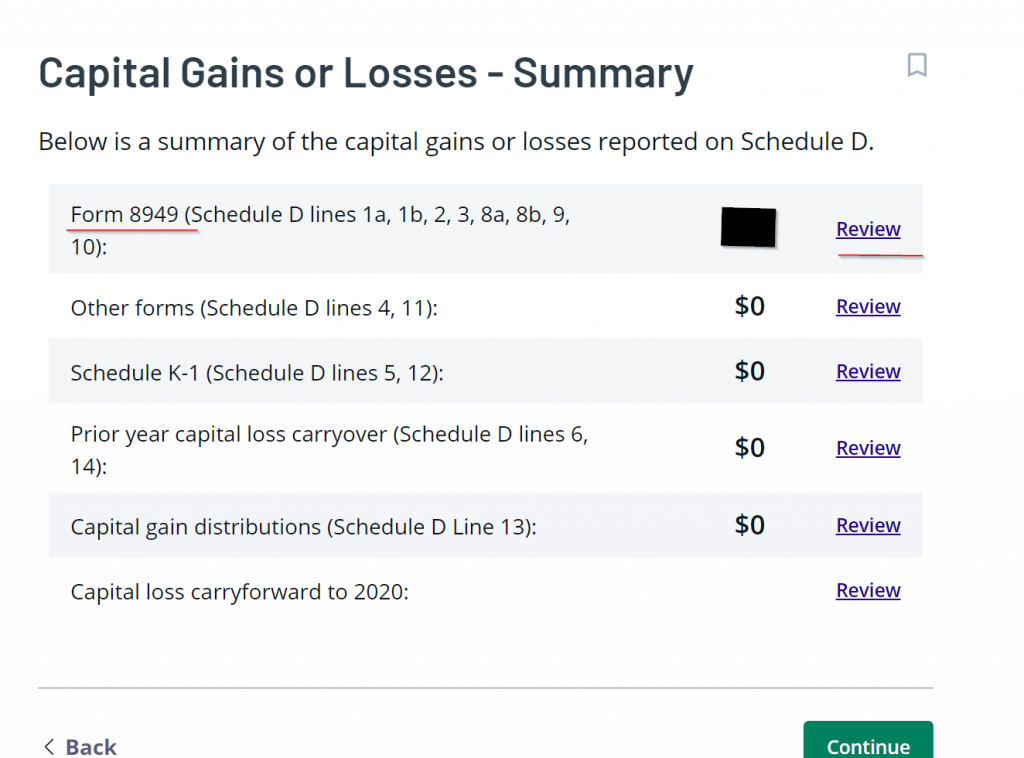

How Do I Enter Employee Stock Purchase Plan Espp Sales In Turbotax

Qualified Small Business Stock Qsbs Tax Benefit Carta

What You Need To Know About Employee Stock Purchase Plan Espp Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Canada Capital Gains Tax Calculator 2022

How To Build An Employee Stock Purchase Plan

Reporting The Sale Of Stock From An Employee Stock Purchase Plan Espp Turbotax 2015

Calculating Adjusted Cost Base When Purchasing Foreign Currency Securities Adjusted Cost Base Ca Blog

![]()

Income Tax Calculator 2022 Canada Salary After Tax

Employee Stock Purchase Plan Espp The 5 Things You Need To Know

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Employee Stock Purchase Plan Espp The 5 Things You Need To Know

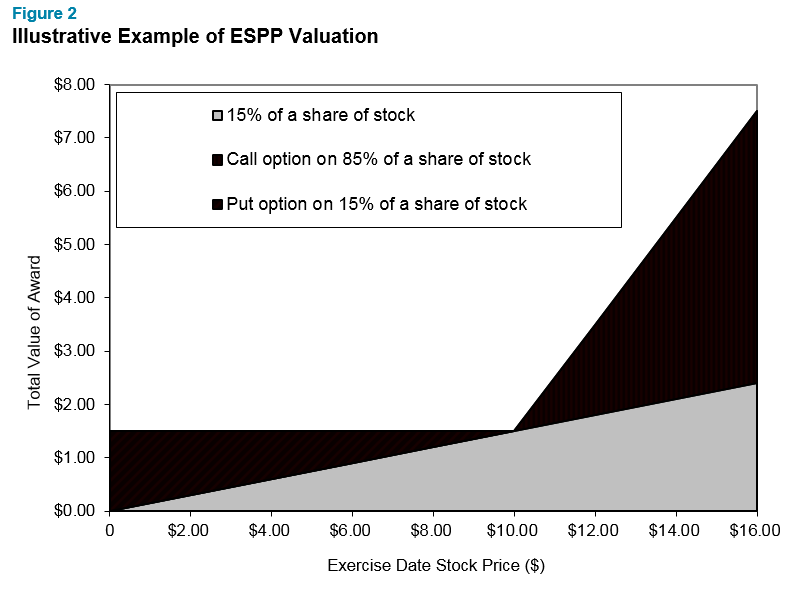

Determining The Fair Value Of Your Espp Human Capital Solutions Insights

Capital Gains Tax Calculator The Turbotax Blog

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)